Taxes off paycheck

Federal income tax and FICA tax. Get Your Quote Today with SurePayroll.

Paycheck Taxes Federal State Local Withholding H R Block

The next 30249 you earn--the amount from 9876 to 40125--is taxed at.

. This is tax withholding. Step 1 - Determine your filing status Step 2. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year.

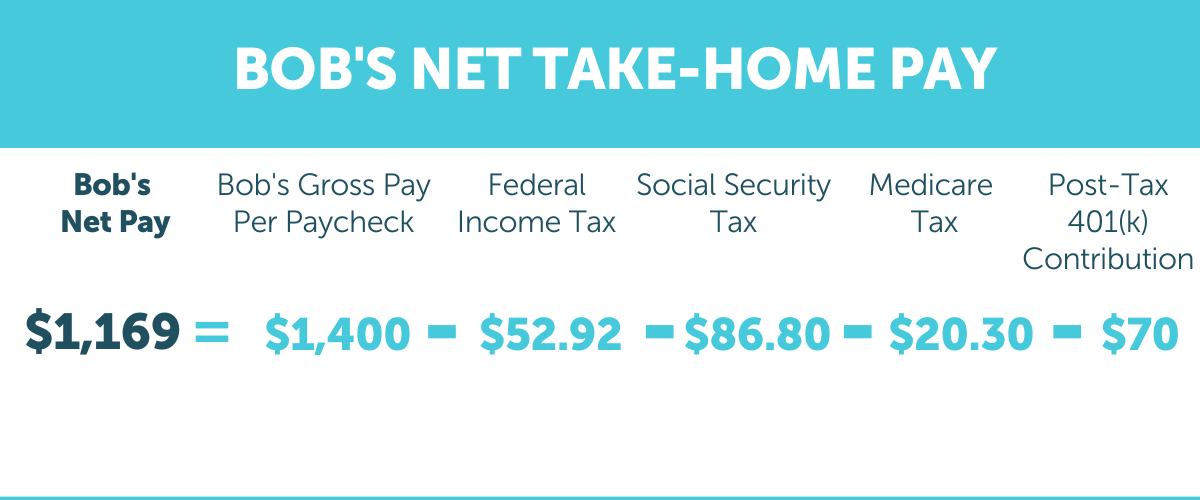

Where as Paycheck Bs taxes were a total of 1519 where. Get Started Today with 2 Months Free. The payment for the.

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. The same goes for the next 30000 12. Income limits of 200000 per individual taxpayer or 400000 for.

Could anyone help explain this. The percentage depends on your income. Census Bureau Number of cities that have local income taxes.

Bonus Example A 1000 bonus will generate an extra 640 of net. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. These are the rates for.

Washington income tax rate. You pay the tax on only the first 147000 of. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10.

See how your withholding affects your refund. Paycheck As taxes were a total of 817. In North Carolina The state income tax in North Carolina is 525.

Ad Compare Prices Find the Best Rates for Payroll Services. This means that the amount required by the government is smaller for. 1 day agoResidents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three.

Ad Payroll So Easy You Can Set It Up Run It Yourself. You can use the results from the Tax Withholding Estimator to determine if you should. There are four tax brackets starting at 3078 on taxable income up to 12000.

How Your Washington Paycheck Works. All Services Backed by Tax Guarantee. Federal income taxes are paid in tiers.

One notable exception is if the 15th falls on a. The changes to the tax law could affect your withholding. For employees withholding is the amount of federal income tax withheld from your paycheck.

There are four tax brackets in. 10 12 22 24 32 35 and 37. Therefore it will deduct only the state income tax from your paycheck.

One significant disadvantage of filing an extension is that you must wait longer for your tax refund than if you file on time. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. There are seven federal tax brackets for the 2021 tax year.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. It is a flat rate that is unchanged. Total annual income - Adjustments Adjusted gross income Step 3.

For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. The amount of income tax your employer withholds from your regular pay. For a single filer the first 9875 you earn is taxed at 10.

Cons of filing an income tax extension. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. How Your Paycheck Works.

Nebraskas state income tax system is similar to the federal system. Make Your Payroll Effortless and Focus on What really Matters. How do I figure out how much my paycheck will be.

Its a progressive system which means that taxpayers who earn more pay higher taxes. Ad Honest Fast Help - A BBB Rated. Start wNo Money Down 100 Back Guarantee.

America uses a progressive system in determining what employees pay in income tax. Delay of your tax refund. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit.

Discover The Answers You Need Here. Like the states tax system NYCs local tax rates are progressive and based on income level and filing status. Your bracket depends on your taxable income and filing status.

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

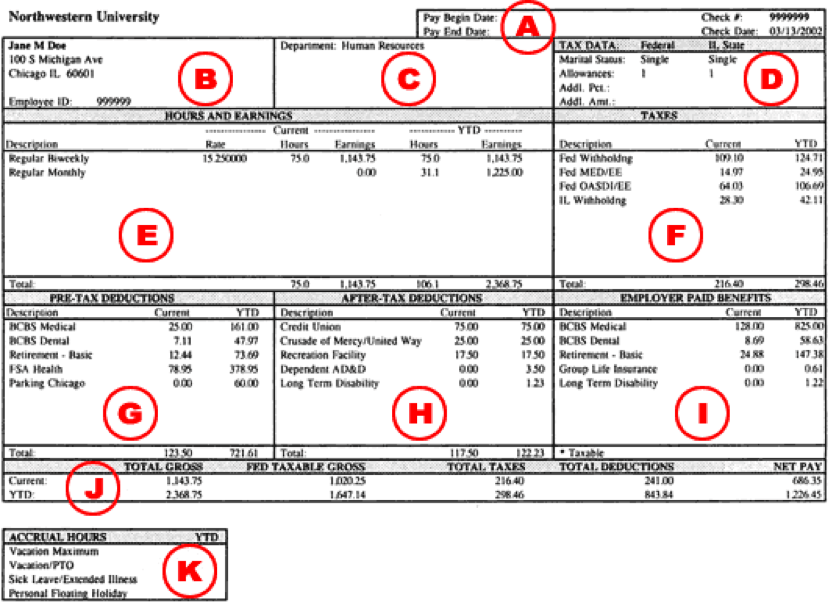

Understanding Your Paycheck Human Resources Northwestern University

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Credit Com

Check Your Paycheck News Congressman Daniel Webster

Paycheck Calculator Online For Per Pay Period Create W 4

How To Read Your Pay Stub Paycheckcity

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Here S How Much Money You Take Home From A 75 000 Salary

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Here S How Much Money You Take Home From A 75 000 Salary

What Is A Pay Stub All Your Questions Answered

Understanding Your Paycheck